Free Online Personal Finance Courses and Certifications 2024

Personal finance is the process of managing one's money to achieve personal financial goals. It involves budgeting, saving, investing, and protecting one's assets. Courses in personal finance are available to help individuals understand the basics of financial planning. It is suitable for people of all ages and backgrounds, and is especially important for those in business or finance-related fields.

Popular Courses

Take control of your financial future and learn how to manage your money with this course for young adults. Gain the ability to budget effectively, choose and manage savings accounts, borrow sensibly and plan ahead to make your goals financially achievable. Suitable for 16-18 year olds preparing for life after school or college, and those in their early 20s. Funded by The Chartered Accountants’ Livery Company Charity.

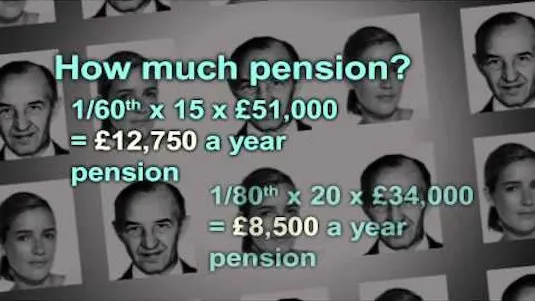

Learn MoreLearn the basics of financial planning and financial wellbeing with this four-week course from the Chartered Insurance Institute. Explore the different financial needs at each life stage, develop effective strategies for investing and saving, and discover estate planning, retirement planning, and pension advice. Suitable for anyone starting out in the financial planning sector or looking to better manage their financial future.

Learn MoreDiscover the fundamentals of mortgages and the process of buying a home with this four-week course from the Chartered Insurance Institute. Learn the roles of the estate agent, lender, and conveyancer, understand the lending and financing process, and gain the confidence and knowledge to secure a mortgage best suited to your needs.

Learn MoreThis course is perfect for those who want to gain a better understanding of finance. It is designed to provide a comprehensive overview of the basics of finance, from accounting concepts to financial statement analysis and budgeting. With the 'Cafeteria' approach, students can gain a better understanding of the fundamentals of finance and develop their 'Finance Sense'. Learn the basics of accounting, financial statements, financial statement analysis, budgeting, capital budgeting, sources of finance, and the time value of money.

Learn MoreTake control of your finances and sign up for this course today!

Learn MoreStart learning the money skills you need to make informed decisions today.

Learn MoreLearn to make smart financial decisions with this six-week course from The University of Michigan. Develop the tools to take control of your finances, understand the Time Value of Money, explore smarter budgeting and financial planning, and understand the complex world of stocks and bonds.

Learn MoreAprenda a criar um orçamento pessoal e familiar eficaz, descubra ferramentas para fazer o seu orçamento, obtenha uma planilha de orçamento, descubra ideias de renda extra, saiba como tirar o MEI e legalizar seu próprio negócio e reorganizar seus gastos. Inscreva-se no nosso tutorial gratuito de orçamento pessoal e familiar + renda extra!

Learn MoreUnlock the secrets of financial stability with "The Zen of Saving." Whether you're a seasoned money manager or new to the game, this course empowers you to take charge of your finances. Dedicate just 1-2 hours weekly to enhance your financial literacy and boost your savings. Delve into the concept of cash flow, the cornerstone of personal financial planning. Lay a solid foundation for future topics and stay tuned for more insights to come. Take control of your financial journey today and embrace a harmonious path towards financial well-being.

Learn MoreThis course will provide an in-depth exploration of the behavioral aspects of financial decision making and personal finance planning. Students will gain an understanding of the theoretical, mathematical, and empirical underpinnings of anomalies and biases that investors face in financial markets. Through discussions, mathematical illustrations, and experimental exercises, participants will become familiar with the terminology, techniques, and approaches used in the behavioralized financial services industry. This course is ideal for BTech/BE students with a basic knowledge of Economics and Statistics, as well as MBA/MCom/MA (Eco)/BBA/BM students. Companies from the BFSI (Banking, Financial services & Insurance) sector, such as Edelweiss Fin. Services Ltd., Barclays India, Yes Bank, CFA Institute, Capital First Ltd., Nomura, and other financial advisory firms, including investment banking companies such as JPMC, DB, etc., will provide industry support.

Learn MoreThis program provides teens with the essential knowledge and skills to become financially literate. Through this program, teens will gain the tools they need to make informed financial decisions.

Learn MoreGain the skills to effectively manage your personal finances by setting S.M.A.R.T. goals and calculating the necessary funds to achieve them. Learn how to make sense of your finances today.

Learn MoreThis course offers professionals the tools and strategies needed to achieve financial independence through savings and investing. Learn how to take control of your finances and secure your future.

Learn MoreLearn from Professor Art Carden how to manage your personal finances and build wealth. Discover strategies to eliminate debt and create a secure financial future.

Learn MoreThis comprehensive guide provides the essential tools to help you achieve financial freedom. Learn how to budget, manage credit, navigate student loans, invest, and save for retirement.

Learn MoreGain a comprehensive understanding of personal finance in the U.S. with this series of concise, engaging, animated videos. Learn the basics of budgeting, saving, investing, and more with Personal Finance 101.

Learn More Personal Finance Courses

Career Trends

Career Prospects

| Average Salary | Position Overview

|

Personal Banker | $45,109 per year

| Personal Bankers provide assistance to customers in opening checking and savings accounts, obtaining credit cards, and securing loans for their businesses. They also play a vital role in maintaining customer relationships by addressing any issues or disputes that arise and finding effective solutions to resolve them. |

Financial Counselor | $46,500 per year | Financial Counselors are responsible for identifying and helping patients who may face difficulty paying their estimated healthcare costs before or after treatments. They provide guidance and support to patients who have significant outstanding balances or are experiencing financial hardship, and work with them to develop payment plans and explore alternative financial assistance options. |

Senior Product Marketing Manager | $138,738 per year | Senior Product Marketing Managers play a crucial role in optimizing a company's marketing strategies, increasing market share, and improving competitiveness. They conduct extensive research on consumer trends, develop effective marketing strategies, and closely monitor customer satisfaction levels to ensure that the company's products and services meet customer needs and preferences. |

Tax Manager | $112,513 per year | The main responsibility of a Tax Manager is to ensure that their organization's tax strategy is in compliance with local, state, and federal tax laws. They also perform various tax-related duties to mitigate their organization's audit risk. Tax Managers are essential to the smooth operation of businesses worldwide, as they help ensure compliance with tax regulations and minimize the risk of financial penalties or legal consequences. |

Senior Finance Manager | $78,525 per year | A Senior Finance Manager plays a critical role in overseeing their company's investment decisions and developing strategic financial goals. They are responsible for managing and supervising financial managers and analysts who study the organization's economic data and provide insights and recommendations to help achieve financial objectives. The Senior Finance Manager's expertise and guidance are essential in ensuring the financial stability and growth of the company. |

Educational Paths

1. Bachelor's degree in finance or accounting

2. Master's degree in business administration (MBA) with a focus on finance

3. Certificate programs in financial planning or financial management

4. Online courses and tutorials on personal finance topics such as budgeting, investing, and retirement planning

5. Self-study using books, articles, and podcasts on personal finance and financial planning.

Frequently Asked Questions and Answers

Q1: How to learn personal finance?

Achieving financial success starts with understanding the basics of personal finance. Here are three key principles to keep in mind:

1. Set clear goals. Having a clear vision of what you want to achieve financially will help you stay motivated and focused on the hard work of budgeting and saving.

2. Prioritize needs over wants. It's important to differentiate between the two and make sure you're not overspending on things you don't need.

3. Pay yourself first. Make sure you're setting aside a portion of your income for savings and investments before you start spending.

Q2: What is personal finance?

As per Investopedia, "Personal finance encompasses all the financial decisions and actions taken by an individual or household, which include budgeting, insurance, mortgage planning, savings, and retirement planning." Familiarizing yourself with these concepts can empower you to effectively manage your finances and lay the foundation for future financial prosperity.

Q3: What are the 4 rules of personal finance?

The fundamental principles of finance encompass income, savings, spending, and investing. Adhering to these key tenets of personal finance is instrumental in sustaining a healthy financial situation. In numerous instances, these principles also serve as a foundation for individuals to accumulate wealth gradually over time.

Q4: What Personal Finance courses can I find on AZ Class?

On this page, we have collected free or certified 486 Personal Finance online courses from various platforms. The list currently only displays up to 50 items. If you have other needs, please contact us.

Q5: Can I learn Personal Finance for free?

Yes, If you don’t know Personal Finance, we recommend that you try free online courses, some of which offer certification (please refer to the latest list on the webpage as the standard). Wish you a good online learning experience!