Personal Finance Part 1: Investing in Yourself

This course provides an introduction to personal finance, focusing on investing in yourself. It covers topics such as saving for a house or retirement, understanding taxes, and deciding whether to invest in education/training, stocks or bonds. It is designed to help individuals take control of their finances and make informed decisions. ▼

ADVERTISEMENT

Course Feature

![]() Cost:

Cost:

Free

![]() Provider:

Provider:

Edx

![]() Certificate:

Certificate:

No Information

![]() Language:

Language:

English

![]() Start Date:

Start Date:

Self paced

Course Overview

❗The content presented here is sourced directly from Edx platform. For comprehensive course details, including enrollment information, simply click on the 'Go to class' link on our website.

Updated in [March 06th, 2023]

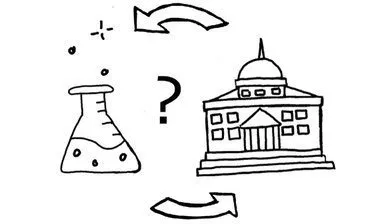

This course, Personal Finance Part 1: Investing in Yourself, will provide students with the knowledge and skills to take control of their finances. Students will learn how to evaluate investments in education and training, use economic tools to evaluate the worth of investments, and make the most of their skills and abilities. Topics covered include Human Capital Investment, Net Present Value (NPV), Internal Rate of Return (IRR), Parameterized Spreadsheet Analysis, Employment Contracts & Making the Most of Work Benefits, Developing a Business Plan, and Paying for Health Insurance and Saving for Retirement When You Are Self-Employed. With this course, students will gain the confidence to make informed decisions about their personal finances and become financially savvy consumers.

[Applications]

Upon completion of this course, participants should be able to apply the concepts learned to their own personal finances. They should be able to evaluate investments in education and training, understand how to use economic tools to evaluate investments, and make the most of their skills and abilities. Participants should also be able to develop a business plan, pay for health insurance, and save for retirement when self-employed.

[Career Paths]

1. Financial Planner: Financial planners help individuals and businesses create and manage their financial plans. They provide advice on investments, taxes, retirement, estate planning, insurance, and other financial topics. Financial planners must stay up to date on the latest financial trends and regulations, and they must be able to explain complex financial concepts in a way that their clients can understand.

2. Investment Banker: Investment bankers help companies and governments raise capital by issuing securities. They also advise clients on mergers and acquisitions, and they provide financial analysis and advice on investments. Investment bankers must have a strong understanding of financial markets and regulations, and they must be able to analyze complex financial data.

3. Financial Analyst: Financial analysts provide advice to businesses and individuals on investments, taxes, and other financial topics. They must be able to analyze financial data and make recommendations based on their findings. Financial analysts must stay up to date on the latest financial trends and regulations, and they must be able to explain complex financial concepts in a way that their clients can understand.

4. Financial Manager: Financial managers are responsible for managing the financial activities of a company or organization. They must be able to analyze financial data and make decisions based on their findings. Financial managers must stay up to date on the latest financial trends and regulations, and they must be able to explain complex financial concepts in a way that their clients can understand.

[Education Paths]

Recommended Degree Paths:

1. Bachelor of Business Administration: This degree provides a comprehensive overview of business principles and practices, including accounting, finance, economics, marketing, and management. It also covers topics such as business law, ethics, and international business. This degree is ideal for those looking to pursue a career in finance, as it provides a strong foundation in the fundamentals of business and finance. Additionally, the degree is becoming increasingly popular due to its flexibility and the growing demand for business professionals.

2. Master of Science in Financial Engineering: This degree is designed for those who want to specialize in the field of finance. It focuses on the application of mathematical and computational methods to financial decision-making. Students learn to use quantitative methods to analyze financial markets, develop financial models, and design financial products. This degree is becoming increasingly popular due to the growing demand for financial engineers in the industry.

3. Master of Science in Investment Management: This degree is designed for those who want to specialize in the field of investment management. It focuses on the application of financial theories and principles to the management of investments. Students learn to analyze financial markets, develop investment strategies, and manage portfolios. This degree is becoming increasingly popular due to the growing demand for investment professionals in the industry.

4. Master of Science in Financial Risk Management: This degree is designed for those who want to specialize in the field of financial risk management. It focuses on the application of financial theories and principles to the management of financial risks. Students learn to analyze financial markets, develop risk management strategies, and manage portfolios. This degree is becoming increasingly popular due to the growing demand for risk management professionals in the industry.

Course Provider

Provider Edx's Stats at AZClass

Personal Finance Part 1: Investing in Yourself introduces personal finance with a focus on investing in yourself. It covers topics like saving for a home or retirement, understanding taxes, and deciding whether to invest in education/training, stocks, or bonds. It is designed to help individuals take control of their finances and make informed decisions. Learners can learn various topics related to personal finance from this course. They will learn about investing in human capital and how to evaluate investments using economic tools such as net present value and internal rate of return. They will also learn how to make the most of their skills and abilities, whether they are working for themselves or for others.

Discussion and Reviews

0.0 (Based on 0 reviews)

Explore Similar Online Courses

Developing Cloud-Native Apps w& Microservices Architectures

Tools for Academic Engagement in Public Policy

Python for Informatics: Exploring Information

Social Network Analysis

Introduction to Systematic Review and Meta-Analysis

The Analytics Edge

DCO042 - Python For Informatics

Causal Diagrams: Draw Your Assumptions Before Your Conclusions

Whole genome sequencing of bacterial genomes - tools and applications

Managing My Money for Young Adults

The Core Four of Personal Finance

Start your review of Personal Finance Part 1: Investing in Yourself