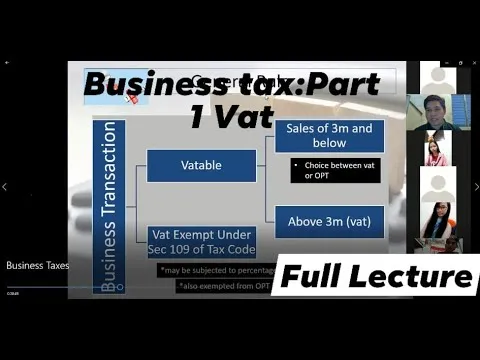

Business Tax -Value Added Tax (VAT) Part 1

This course provides an introduction to Value Added Tax (VAT) and its implications for businesses. It covers the basics of VAT, including the different rates, exemptions, and how to register for it. It also explains the different types of VAT returns and how to complete them. This course is ideal for business owners and entrepreneurs who want to understand the basics of VAT and how it affects their business. ▼

ADVERTISEMENT

Course Feature

![]() Cost:

Cost:

Free

![]() Provider:

Provider:

Youtube

![]() Certificate:

Certificate:

No Information

![]() Language:

Language:

English

![]() Start Date:

Start Date:

2020-07-12 00:00:00

Course Overview

❗The content presented here is sourced directly from Youtube platform. For comprehensive course details, including enrollment information, simply click on the 'Go to class' link on our website.

Updated in [July 25th, 2023]

This course provides an introduction to Value Added Tax (VAT) and its application in business. It covers the fundamentals of VAT, including the different types of VAT, the registration process, and the calculation of VAT. It also covers the filing of VAT returns and the payment of VAT. Participants will gain an understanding of the principles of VAT and how it applies to their business.

Course Provider

Provider Youtube's Stats at AZClass

Discussion and Reviews

0.0 (Based on 0 reviews)

Explore Similar Online Courses

Offseason Training for Soccer - Online Soccer Academy

How To Start A T-shirt Business For Under $3

Python for Informatics: Exploring Information

Social Network Analysis

Introduction to Systematic Review and Meta-Analysis

The Analytics Edge

DCO042 - Python For Informatics

Causal Diagrams: Draw Your Assumptions Before Your Conclusions

Whole genome sequencing of bacterial genomes - tools and applications

VAT on Municipalities

Value Added Tax (VAT) - For F6 - TX (UK)

Start your review of Business Tax -Value Added Tax (VAT) Part 1